It is a strange, unsettling symmetry: a country that proclaims itself a beacon of human rights and charitable giving — Canada — yet behind the façade of benevolence, its philanthropic machinery is implicated in sustaining one of the most intractable occupations of our age. According to the CBC investigation, several Canadian-registered charities are indirectly funnelling tax-deductible donations into networks that support the settlement movement in the occupied territory of the West Bank.

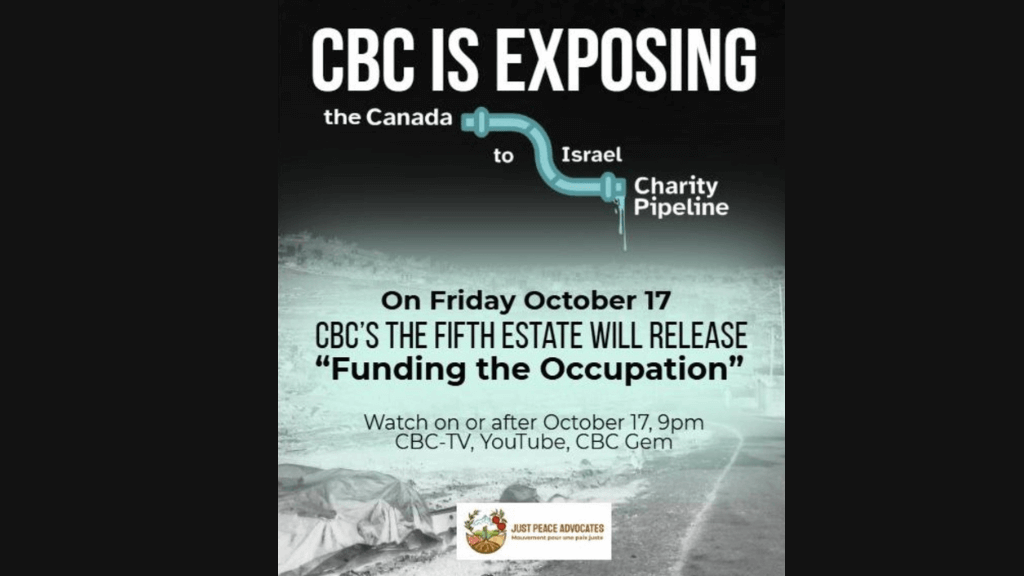

In Canada, at a moment when the rhetoric of compassion and justice is everywhere, a quieter story is unfolding—or rather, being revealed: Canadian charitable donations are flowing into the machinery of occupation. According to reporting by CBC News, Fifth Estate, several registered Canadian charities and non-profits have been accused of funnelling funds that ultimately support the network of Israeli settlements across the West Bank—territory regarded under international law as occupied.

The story goes like this: These charities harness the moral currency of charitable giving in Canada—tax-deductible status, public goodwill—but the destination of the money is troubling.

Some funds go to organizations tied to the settlement enterprise, infrastructure projects, or other forms of support that evidence shows facilitate the dispossession and subjugation of Palestinians. What begins as a modest Canadian donation in Toronto or Vancouver becomes part of a larger architecture of occupation and ethnic cleansing.

One Canadian non-profit singled out is the HESEG Foundation, which provides scholarships to ‘lone soldiers’ who have served in the Israeli military. The article points out how Canadian charitable status allows such donations to be tax-deductible, even when critics say the work benefits those engaged in the settlement state’s project. While the CRA (Canada Revenue Agency) maintains that charities must operate within the law, critics argue that, in practice, oversight is minimal and funds flow with virtually no public accountability.

Legal and Moral Contradictions

The article quotes experts who say that Canada’s charitable system is inadvertently (or perhaps, one might say, negligently) complicit in the expansion of settlements illegal under international law. The settlements, by virtue of being built on land seized and held against the will of the indigenous population, violate the Fourth Geneva Convention and other norms. Yet the Canadian system of registered charities lacks a mechanism to prevent tax-deductible gifts from being channelled into that irreversible process.

We must not lose sight of the people on the ground. For Palestinians in the West Bank, the settlements mean loss of land, movement restrictions, demolition of homes, and fragmentation of communities. The charitable donations in Canada, when linked — even indirectly — to infrastructure or services that enable settlements, become part of that machinery of dispossession.

When Canadians write a cheque to a charity, believing they are doing good, they must reckon with the possibility that their giving is empowering a project that perpetuates inequality, occupation and injustice.

From the vantage of Mount Royal to the hills of the West Bank, the story is clear: donors in Canada remain largely unaware that their charitable impulses may be funding the very structures of oppression they would profess to oppose. Meanwhile, the Canadian government’s statement—that it “makes sure” charities follow the rules—rings hollow in the absence of meaningful auditing or the revocation of charitable status when rules are broken.

Why this Matters to Canada

Canada likes to view itself as a “good international citizen,” a promoter of peace, human rights, and global development. But if its charitable laws are being used as a conduit for occupation support, then we must ask: what kind of “good citizen” are we being? What does it say about our national self-image when our generosity is, perhaps unwittingly, contributing to injustice?

There is, too, a haunting familiarity in this story for Canada itself. The quiet complicity in another people’s dispossession abroad mirrors the unfinished reckoning with its own history of colonialism at home.

This is a country that speaks the language of reconciliation while survivors of its residential schools still await justice. A nation that proclaims respect for Indigenous rights even as communities on its own land lack clean water, are displaced by resource projects, and continue to fight for the return of what was stolen.

The pattern is unmistakable: the colonizer’s vocabulary has simply evolved—from “civilization” to “charity,” from “terra nullius” to “foreign aid.” The moral dissonance is the same.

Canada, a state built on the erasure of its First Nations, now sanctions — through tax breaks and indifference — the ongoing erasure of another Indigenous people half a world away.

Until Canada confronts this continuity — the thread between its internal colonial past and its external alliances — it will remain, however politely, a nation fluent in the language of empathy yet complicit in the architecture of oppression.

What needs to happen

Unless Canadians demand accountability—from charities, the CRA, and elected officials—the pipeline of “good intentions” into occupation will continue unabated. If we value justice, we cannot stay silent or complacent. We must insist that our generosity does not enable someone else’s dispossession and ethnic cleansing.

- The CRA must undertake transparent audits of charities receiving donations that are potentially routed to settlement-linked organizations, publish their findings, and revoke charitable status where misconduct is found.

- Donors must be given full disclosure of how funds are used, and charities must provide rigorous reporting on downstream recipients.

- Civil society and media must shine a persistent light on these flows, so that Canadian compassion is not distorted into complicity.

- Canadians must demand that their philanthropy aligns with human rights principles, not undermines them.

It's time to end the Canada-Israel charity pipeline.

Take Action!

“The CRA is well awareof Canadian charities violating its own policies as well as international and domestic law. The CRA violates its own policies by:

Allowing charities to support foreign military (in contravention of the Public Benefit Test, CG-002 Section 4).

Failing to ensure charities fulfill their duties under the Income Tax Act, specifically by failing to accurately report their revenue and expenses, at times, completely missing a tax filing, or failing to complete whole sections of their tax return.

The CRA violates international law by:

Allowing upholding the charitable status of organizations who violate international laws such as the Fourth Geneva Convention, Rome Statute,and Genocide Convention.

The CRA is required, by international law, to “carefully review any organization that is financially or politically supporting the unlawful occupation.” Specifically, Canada must not “give support to these organizations, for example through allowing the organization to have tax-exempt status or providing tax deductibility for donations to the organization and must ensure that financial contributions to support the unlawful occupation, including settlements and settlers, cease.”

The CRA violates domestic law through various legislation including:

Income Tax Act, Foreign Enlistment Act, Crimes Against Humanity and War Crimes Act, and the Geneva Conventions Act

Canadian charities, regulated by the CRA, are actively funding Israeli occupation, apartheid, and genocide. This is not simply about “violent settlers.”

Irregardless of individual settlers carrying out attacks, settler presence in the West Bank through outposts, settlements, or new infrastructure is illegal under international law and against Canadian public policy.“

Campaign promoted by Just Peace Advocates (JPA)

Read the article by Yves Engler

October 17, 2025. “The total wealth transfer is staggering and entirely unique. Assuming donations have been flowing at a similar rate to today, it’s likely that Canadian taxpayers have subsidized $20 billion sent to projects in Israel since the federal government introduced deductions for charities in 1967. (That doesn’t include hundreds of millions of dollars more — probably a billion dollars annually — raised by charities promoting genocide domestically such as Honest Reporting Canada, Magen Herut Canada and TanenbaumCHAT. Blumberg claims there are a thousand “Jewish charities” with a whopping $12 billion in assets. While many likely have little to do with Israel, it’s safe to assume that most include an Israel element.)” Here…

Read the article by Davide Mastracci - The Maple

July 23, 2025. “I found that 434 second-level charities donated at least $1 to at least one of the four top-level charities in the project during the calendar years of the relevant CRA audit period. Together, these charities donated more than $70 million to these top-level charities during all of the calendar years of the audit periods combined (a total of nine years).” Here…

Read the article by Independent Jewish Voices Canada (IJV)

“Ottawa, April 12, 2024–Grassroots advocacy groups Just Peace Advocates (JPA) and Independent Jewish Voices Canada (IJV) are calling on the federal government to take immediate action in the case of a Canadian charity sending taxpayer-subsidized funds to Israeli organizations involved in the commission of war crimes.

The Mizrachi Organization of Canada, registered as a charity since 1979, identifies its charitable objective as the “relief of poverty”. Its tax filings, however, paint a different picture. As revealed in an open letter sent yesterday to Minister of National Revenue Marie-Claude Bibeau, Mizrachi Canada has for years been providing tax-receipts for Canadians wishing to support the extremist settler movement and the Israeli military. JPA and IJV are also circulating a parliamentary petition on the same subject, sponsored by NDP National Revenue Critic Niki Ashton. The petition has already garnered over 4000 signatures since being published on Wednesday evening.” Here…